Business Clearance Philippines: Permits Guide & Requirements

A Business Clearance Certificate is important for operating a legal business in the Philippines. This certificate is issued by the barangay, the smallest administrative division and the basic unit of local government, Philippines. Business Clearance certificate confirms that a business owner has met the specific requirements of the barangay and has received the necessary approvals to run their business legally within the community.

Who Needs a Business Permit?

All businesses operating in the Philippines need a business permit. It helps Local Government Units (LGUs) to track businesses and reassure clients and stakeholders that your business has a lawful entity. It is mandatory to apply for renewal of this certificate when expires.

Importance of a Business Clearance Certificate

- Lawfulness

The certificate is essential for establishing an authentic business. Operating a business without it is illegal and may result in fines, penalties, or even business closure.

- Community Approval

It shows that the local community is aware of and has no objection to the business.

- Regulatory Compliance

Getting this certificate represents that the business follows the local rules and meets the community standards set by the barangay.

Impact on Business Operations

- Legal Protection

This certificate guards against legal issues or penalties for not following rules.

- Business Reputation

It builds trust with customers, partners, stakeholders, and financial institutions.

- Smooth Operations

It ensures the smooth execution of business operations by preventing interruptions from local authorities enforcing regulations.

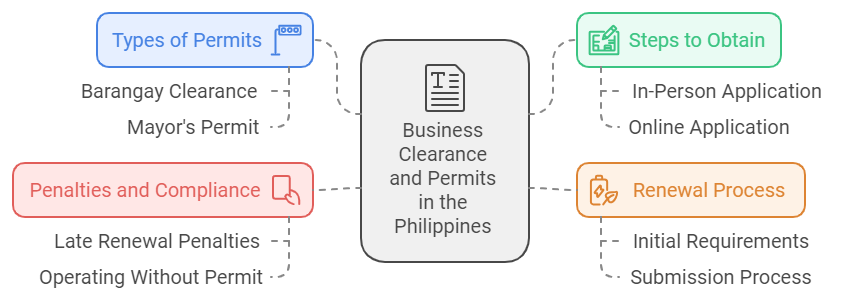

Types of Business Clearance Certificates

In the Philippines, businesses generally need two types of clearances

Barangay Clearance

This is the basic clearance to certify that the business complies with barangay rules and regulations.

Mayor’s Permit (Business Permit)

This is an official license required to operate within the locality, usually at the city or municipal level. A barangay clearance is often a basic requirement for getting a Mayor’s Permit.

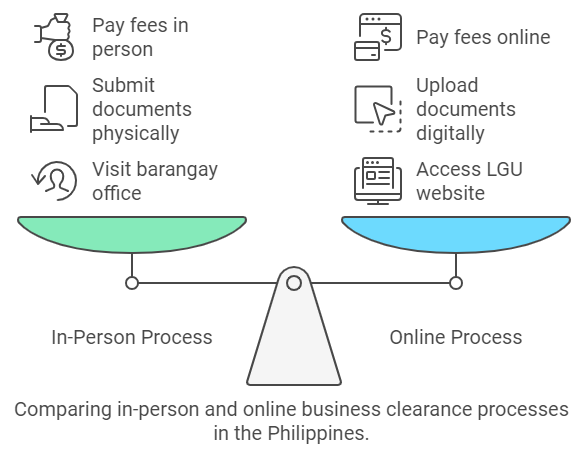

Steps to Obtain a Business Clearance Certificate in Person

1. Start at Your Barangay Office

Visit the barangay office in your business locality and complete the application form.

2. Submit Required Documents

Attach the required documents with the application. Required documents mainly include:

- Completed application form

- Proof of business registration (e.g., DTI certificate for sole proprietorships or entrepreneurship . Securities and Exchange Commission SEC certificate is required for companies)

- Community Tax Certificate (Cedula)

- Lease contract or site map

3. Pay Fees

Fees can range from ₱200 to ₱ 2000, depending on the location and type of business.

4. Obtain Barangay Clearance

Once documents are submitted and fees are paid, the barangay office will issue the clearance certificate.

5. Proceed to the BPLO

Submit your barangay clearance and other documents to the Business Permit and Licensing Office (BPLO) for the Mayor’s Permit.

Obtain a Business Clearance Certificate Online

Some LGUs offer online systems for obtaining business clearances:

- Access the Official LGU Website: Check if your LGU has an online application system.

- Fill Out the Online Form: Provide necessary information and upload digital copies of documents.

- Pay Fees Online: Use the online payment systems provided.

- Receive Clearance: Download or collect the clearance from the barangay office.

Online and In-Person Renewal Processes

Many LGUs have business one-stop shops (BOSS) or online renewal systems. Check your LGU’s website for options. Some LGUs still require in-person visits for document submission.

Fees and Processing Time

- Fees: Can vary from ₱200 to ₱2,000 depending on the barangay and business scope.

- Processing Time: Typically takes one to two weeks, depending on local office efficiency and document completeness.

Comprehensive Guide to Business Permit Renewal in the Philippines

Understanding Business Permits and the Importance of their renewal

A business permit, or Mayor’s Permit, is a government license from your LGU, ensuring compliance with local regulations, including tax payments, and health, and safety standards. It is necessary for all businesses and must be renewed annually.

Validity and Renewal

A Business Clearance Certificate is usually valid for one year from the date of issuance. It must be renewed annually to maintain compliance with local regulations. Failure to renew on time can lead to penalties or suspension of business operations.

Renewing your business permit is fundamental for legal operation in the Philippines. It’s best to prepare your documents at least a month before January to meet the deadline to avoid last-minute preparations.

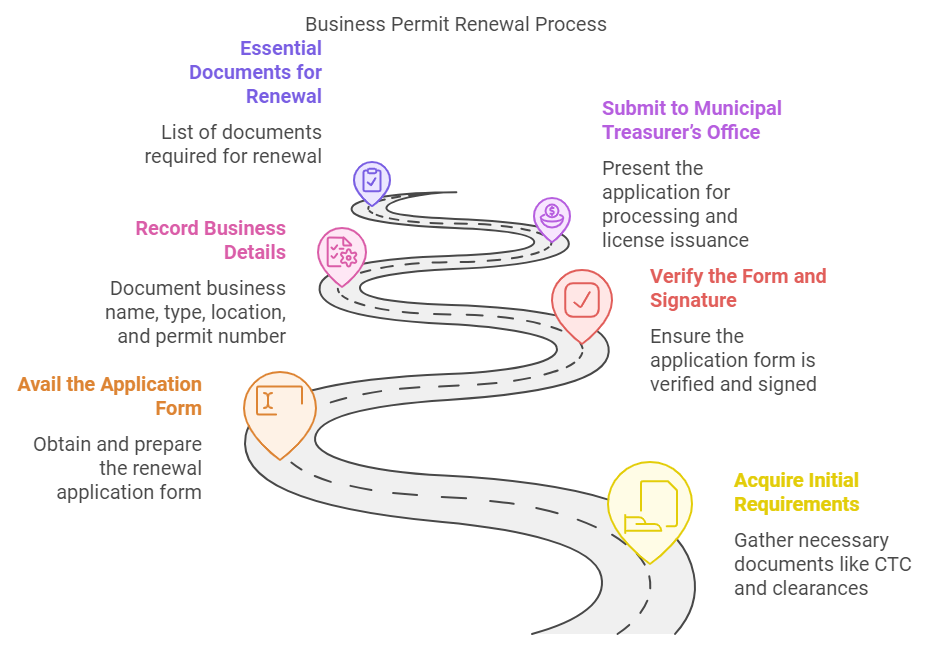

Steps for Processing a Business Permit Renewal

Here’s a step-by-step guide:

- Acquire Initial Requirements:

- Community Tax Certificate (CTC)

- Barangay Clearance

- Mayor’s Certificate of Tax Compliance (MCTC)

- Police Clearance

- 2×2 ID-colored pictures (3 copies)

- Avail the Application Form: Prepare the renewal application form, presenting the old business license or permit.

- Verify the Form and Signature: Verify and sign the application form.

- Record Business Details: Record details such as business name, type, location, and permit number.

- Submit to the Municipal Treasurer’s Office: Present the application for processing and issuance of the business license.

Essential Documents for Renewal

Documents that are typically required :

- Barangay Business Permit

- Business Permit from the Previous Year

- Company Documents (DTI/SEC/CDA registration, income tax returns, audited financial statements)

- Sanitary Permit, Fire Safety Inspection Certificate, if applicable

Penalties for Late Renewal

Late renewal can result in:

- A 25% surcharge on business tax

- An additional 2% penalty per month of non-renewal

- Possible closure or liquidation of assets in case of severe arrears

Additional Considerations

Ensure all necessary registrations and permits are renewed annually, including Barangay Business Permit and BIR annual registration fee. You cannot renew your business permit without an up-to-date Barangay Business Permit.

Read About RTC Clearance Online in Philippines.

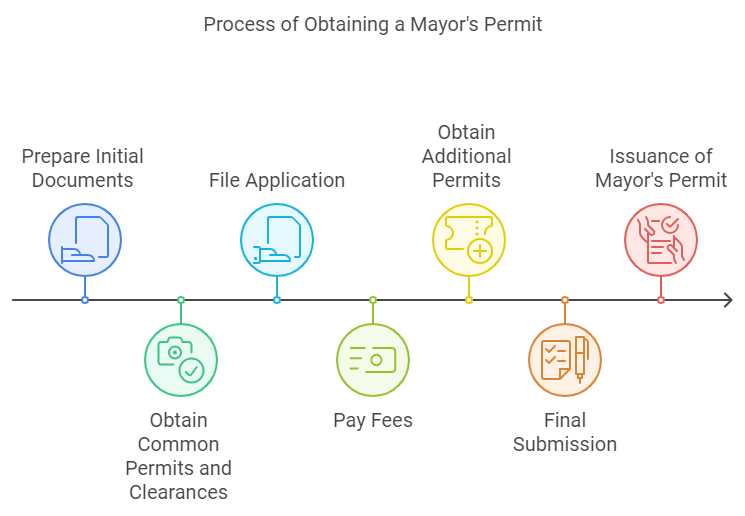

Obtaining a Mayor’s Permit in the Philippines

A Mayor’s Permit, or Business Permit, is essential for legal business operations within a locality. It ensures compliance with safety, health, zoning, and tax regulations. A Mayor’s Permit authorizes legal business operations and ensures compliance with local regulations. Operating without it can result in penalties or business closure.

Step-by-Step Process for Obtaining a Mayor’s Permit

1.Prepare Initial Documents

- Complete application form

- SEC/DTI/CDA registration

- Barangay Business Clearance

- Contract of Lease or Title

- Sketch or pictures of the business location

- Public Liability Insurance (if required)

- Community Tax Certificate

- Locational/Zoning Clearance

- Certificate of Occupancy

- Building Permit and Electrical Inspection Certificate

- Sanitary Permit

- Fire Safety Inspection Permit

2.Common Permits and Clearances

The following essential permits are required to attach.

- Barangay Business Clearance: From the Barangay Hall.

- Locational/Zoning Clearance: Ensures compliance with zoning regulations.

- Certificate of Occupancy, lease and Building Permits: Proves building safety.

- Fire Safety Inspection Certificate: From the Bureau of Fire Protection.

- Sanitary Permit: From the City or Municipal Health Office.

3.File Your Application

Submit the form and documents to the BPLO at the City or Municipal Hall.

4. Pay Fees

Varies by business type and location, including:

- Barangay Business Permit Fees

- Local business tax

- Inspection fees

- Environmental protection and garbage fees

5. Obtain Additional Permits

Obtain the Fire Safety Inspection Permit and Temporary Sanitary Permit.

6. Final Submission

Submit all requirements to the BPLO.

7. Issuance of Mayor’s Permit

A Permit in the form of a certificate is generated once all requirements and fees are filed.

Format or Sample of a Business Clearance Certificate (Philippines)

A typical Business Clearance Certificate format in the Philippines includes:

- Header: The name and address of the business

- Business Information: The type of business and its nature

- Dates: The date of issuance and expiration

- Signatures: Official signatures from the barangay authorized representatives

- Approval Statement: A certification statement confirming compliance with local regulations

Timelines and Validity

Processing times vary; permits generally expire on December 31. Renewals occur from January 1 to January 20. Late renewals may cause penalties.

Need Help with Business Permit Processing?

Professional assistance can simplify the permit acquisition process. Business Permit Processing Service can be contacted for expert guidance.

Conclusion

Obtaining new or a renewal of Business Clearance Certificates and Mayor’s Permits are basic steps for operating a legal business in the Philippines. Understanding the process, preparing the necessary documents, and meeting deadlines ensure smooth operations and compliance with local regulations. Stay informed about the requirements specific to your Local Government Unit (LGU), and seek professional help if needed, to deal with the complexities of business permits efficiently.

If you need help about What you need as First Time Jobseekers Check this Post.

Frequently Asked Questions (FAQs) about Business Clearance in the Philippines

How to Get a Business Permit?

Register your business with DTI or SEC.

Obtain a Barangay Clearance and a Community Tax Certificate.

Submit the required documents to the BPLO.

Pay fees and collect your Mayor’s Permit.

Do Small Businesses Need a Business Permit?

Yes, all businesses, regardless of size, need permits to operate legally.

Why Does One Need a Business Permit?

It is needed to ensure legal operation, and compliance with local laws, and tax regulations.

What Are the Penalties for Late Business Permit Renewal?

A 25% surcharge on the business tax assessed and an additional 2% penalty for every month of non-renewal. Extreme arrears may result in business closure or asset liquidation.

What Should I Do if I Need Help with Business Permit Processing?

Seek professional assistance, like a business permit processing service, to navigate varying requirements across different LGUs.

What are the penalties for operating a business without a Business Clearance Certificate?

Operating a business without a valid Business Clearance Certificate can result in unexpected penalties. These may include fines, closure orders, or legal action by local authorities. The business may also face difficulties in securing other necessary permits. A business may lose credibility with customers, partners, and financial institutions. Additionally, it could lead to future complications when attempting to renew or apply for new permits.

Can a Business Clearance Certificate be transferred if a business is relocated?

No, a Business Clearance Certificate is location-specific and cannot be transferred if the business moves to a new address. You must get a new certificate from the barangay office of the new location. The same process applies if the business expands to another barangay or city; separate clearances are required for each location to ensure compliance with local regulations.