Tax Clearance Certificate Philippines: Comprehensive Guide

In the Philippines, a Tax Clearance Certificate is a document issued by the Bureau of Internal Revenue (BIR). This document is required by businesses or taxpayers so they can bid on government contracts or they may offer businesses or services to the government.

This document serves as evidence that the company or business is following the tax rules and ensuring the timely payment of taxes. It is difficult to get the certificate in case of tax arrears. This may lead to a delay in starting a business. Paying taxes on time is important to save from penalties or extra charges. Tax Clearance certificate is valid for 1 year but it can be invalid in case the business does not comply with the tax rules.

Why Do You Need a Tax Clearance Certificate?

You’ll typically need a TCC for:

- Bidding for government contracts

- Renewing Mayor’s Permit

- Business registration or closure

- Visa processing (some cases)

- Loans and financing

Without this certificate, you may face delays, disqualification from tenders, or legal complications. It’s also a green flag to show your business follows tax regulations.

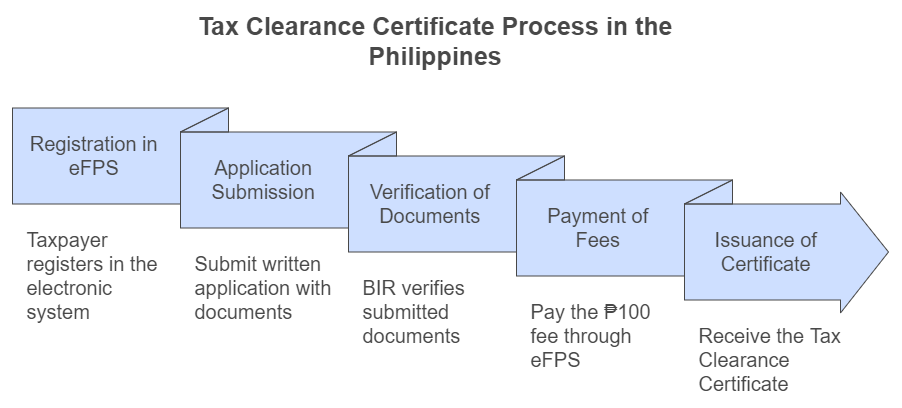

A General Guide for the Tax Clearance Process in Philippines

Tax clearance is an essential prerequisite to demonstrate to investors or customers that the company complies with tax laws or is in good standing. Here is a general guide on the requirements and process details, needed to obtain a Tax Clearance Certificate.

Requirements for obtaining a Tax Clearance Certificate

Primary Requirements:

- Application Letter addressed to the BIR Revenue District Office (RDO)

- Tax Clearance Application Form (download from the BIR website)

- Latest Tax Returns (filed via eFPS)

- BIR Certificate of Registration (COR)

- BIR Form 0605 (Payment Form)

- eFPS Payment Receipt of ₱100 clearance fee

- Certificate of No Tax Liability

- Two loose Documentary Stamps

- Previous Tax Clearance Certificate (if for renewal)

- Valid Government-issued ID

Do’s

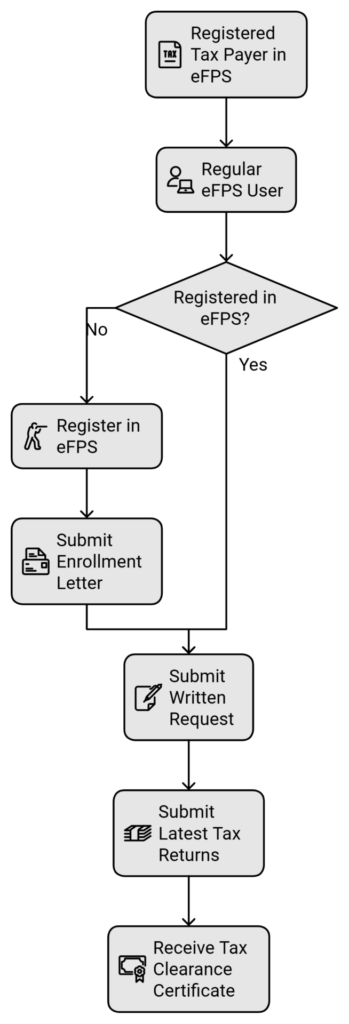

- You must be a registered Tax Payer in eFPS or the BIR Electronic Filing and Payment System.

- You must be a regular user of the eFPS from the time of enrollment to the time you apply to receive or renew your tax clearance certificate.

- In case, you are not registered in eFPS, ensure to apply for it first. Attach the enrollment letter of request with the name, email, position, and contact numbers of 2 authorized users.

- Submit a written request or an application for Tax Clearance.

- If, you are a new applicant, submit your latest income tax and business tax returns to start the process.

Don’ts

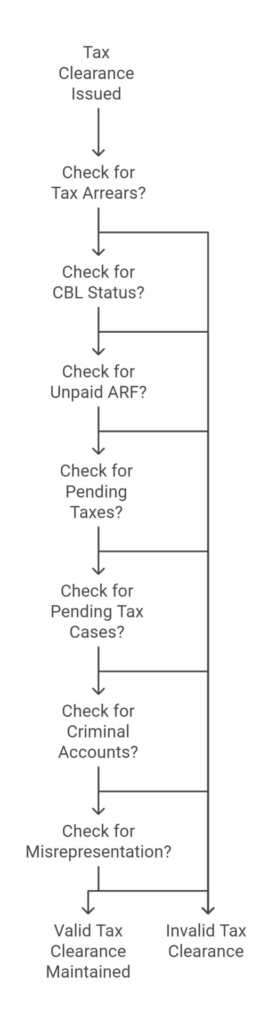

The Tax Clearance has a one-year validity period from the time it is issued. Be careful not to breach the following important points.

- You should not have tax arrears

- You should not be labelled as a CBL taxpayer. (Cannot Be Located Taxpayer)

- You should not have any unpaid annual registration fee or ARF.

- You should not have any pending taxes to be paid.

- You should not be involved in any pending tax case in the court.

- You should not have any criminal account

- You should not have mispresented anything either to the Tax Clearance-issuing office or the government procuring agency.

Who Cannot Get a Tax Clearance?

Avoid these issues to stay eligible:

🚫 Disqualification Reason | 🚫 Explanation |

|---|---|

Outstanding Tax Arrears | Unpaid tax balances must be cleared |

CBL Taxpayer Status | “Cannot Be Located” status prevents issuance |

Pending Tax Case | Tax disputes in court block TCC approval |

ARF Unpaid | Unpaid Annual Registration Fee is a red flag |

Criminal Cases | Involvement in fraud or false tax claims leads to denial |

False Documents | Misrepresentation during application causes automatic rejection |

Read about Business Clearance Process.

Step-by-Step: How to Apply for a Tax Clearance Certificate

Here’s how to get your TCC smoothly in 2025:

- Enroll in eFPS (if not already enrolled)

- Fill out the eFPS Enrollment Form

- Include names and contacts of 2 authorized users

- Submit to your RDO office

- Clear All Dues

- Pay any pending taxes

- File any missed tax returns

- Settle unpaid ARF

- Gather All Required Documents

- Ensure all forms are complete and up to date

- Affix documentary stamps

- Submit to BIR Revenue District Office

- Submit documents personally or via authorized representative

- Keep a receiving copy for follow-up

- Wait for Verification and Approval

- BIR will verify documents, filings, and payments

- Expect 3–7 working days on average

- Receive Your Tax Clearance Certificate

- Once approved, you’ll be issued a physical or e-copy of your clearance certificate

Can I Apply Online?

Currently, the application is semi-digital. You still need to visit the RDO in person, but:

- Payments are made online via eFPS (Electronic Filing and Payment System)

- Some updates may allow email-based submission of renewal documents

- Always verify with your assigned RDO office

Tax Clearance Certificate for No Money or Property

Some individuals request a Certificate of No Money and Property Accountability, especially for real estate or municipal matters.

Use Case | Authority | Requirement |

|---|---|---|

Real Property Tax Clearance | Municipal Treasurer’s Office | Proof of Payment / Receipt |

No Money & Property Certificate | Municipal Treasurer’s Office | ID + proof of no property |

Process for Tax Clearance Certificate

To initiate the process of Tax Clearance, a written application is required to be presented to the Revenue District Officer or RDO along with appropriate documents. After clearance of all unpaid taxes a clearance, the RDO verifies and a certificate is issued in the name of the applicant.

In case of non-payment of tax amount or any arrears, a penalty is charged along with the tax amount. After clearance of all the payments, the RDO issues you a No Tax Liability Certificate. The fee for the Clearance Certificate is ₱ 100. The fee transaction is made through eFPS. It is required to attach the fee receipt with all other important documents.

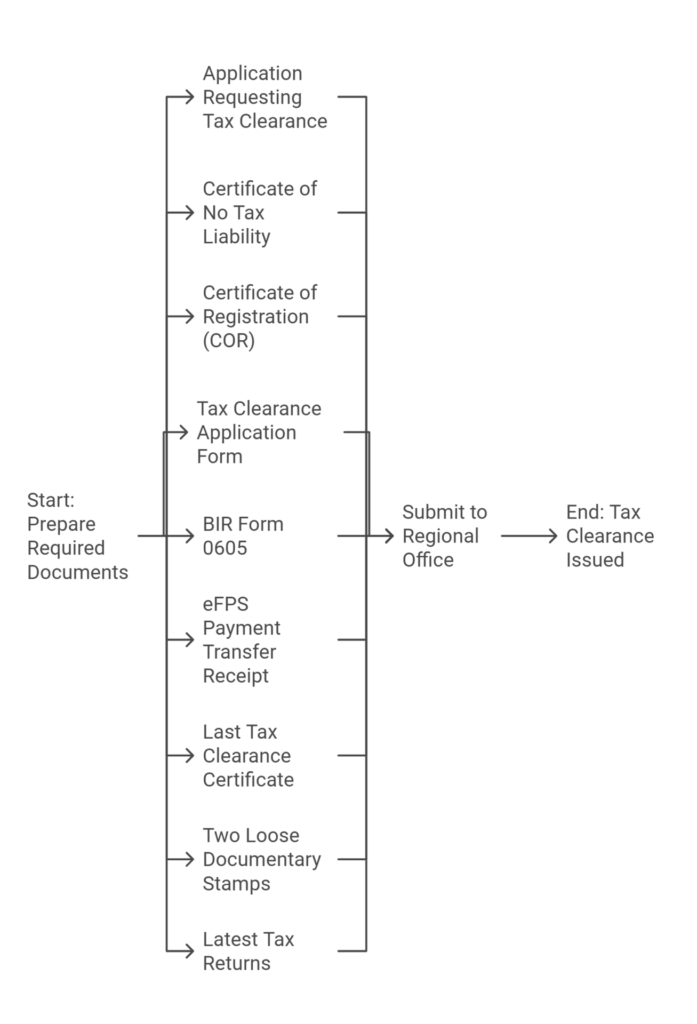

Documents to be attached with the Application

The Tax Clearance Certificate is pivotal to businesses. It favors you by demonstrating that you secure a tax clearance certificate to assure that your business is complying with the tax laws. It is easy to strike the opportunity with the availability of this document after ensuring the credibility of your company as a reliable taxpayer.

The following documents are required to be submitted to the regional office of BIR or the Board of Internal Revenue.

- Application requesting for Tax Clearance

- Certificate of No Tax Liability

- A copy of your Certificate of Registration (COR)

- Tax Clearance Application Form from the website of BIR.

- BIR Form 0605 or the Payment Form

- eFPS payment transfer Receipt

- Last Tax Clearance Certificate

- Two loose documentary stamps

- Latest Tax Returns paid through eFPS

To go through a smooth clearance process make sure you comply with all the requirements mentioned above. After submission of important documents with the application, an applicant has to wait patiently for the release of the clearance certificate as it finally takes some time to be released in your favor. That is why it is recommended to begin working on tax clearance documents beforehand if you intend to apply for any government tender or project to avoid any hassle or discomfort. It is advisable to consult any accounting firm for assistance in bookkeeping, accounting, auditing, or advice on BIR regulations, problems, and solutions.

After the verification of your accounting log and previous tax returns, the BIR representatives issue a clearance certificate in your name. You can get Business Clearance and Permits in Philippines.

Sample Tax Clearance Certificate

Here is a sample to give you an idea how what a |Tax Clearance Certificate looks like.

Do you know How to Get TIN ID, Requirements, Verifications in Philippines

Tax Clearance Validity, Processing Time & Fees

Item | Details |

|---|---|

💸 Fee | ₱100 (paid via eFPS) |

🕒 Processing Time | 3 to 10 working days |

📆 Validity | 1 year (revoked if tax rules are broken) |

Tax Clearance certificate is valid for 1 year but it can be invalid in case the business does not comply with the tax rules. The fee for the Clearance Certificate is ₱ 100. The fee transaction is made through eFPS. After submission of important documents with the application, an applicant has to wait patiently for the release of the clearance certificate as it finally takes some time to be released in your favour.

Final Notes on the Tax Clearance

Tax clearance is a continual process for every business. It is mandatory to undertake. It may appear long and challenging however compliance with the tax code of conduct and and fulfilling your duties as a Filipino business owner is an obligation. This conscientious approach avoids legal issues and supports the long-term success and sustainability of your business.

Want to know about the Police Clearance Certificate?