How to Get TIN ID in Philippines: Requirements, Verification

A taxpayer is a responsible citizen of a country who understands that money contributions from his earnings as a tax are crucial for the betterment and development of his country. As proof that you are a taxpayer and a responsible citizen, you can request a Tax Identification Number (TIN) from the Bureau of Internal Revenue (BIR) Office.

Tax Identification Number (TIN) is a reference number that is issued by BIR to every Filipino registered in the database. In order to get your valid ID, a TIN is a must. You can apply for it even as a student or an unemployed citizen.

Here is a guide on how to get a TIN ID, the processing fee, and the documents required for it.

What Is TIN

The Taxpayer Identification Number Card is also called a TIN Card or TIN ID card. This card is issued to every registered taxpayer in the Philippines. The BIR ID contains personal information like name, DOB, address, picture, issuing date, and signature with a unique tax identification number mentioned on it. This card is issued by BIR Office, with a BIR logo on it. Whether you use previous on yellow-orange TIN card or the new one in green color, both are valid. Its a small, thin cardboard card that can be laminated to prevent scratches or wear and tear.

A TIN ID is basically used to identify the status of a citizen as a registered taxpayer It has a unique identification number used for tax purposes. Since this TIN Card has no expiry date, this card is also considered a valid ID while making financial deals with government institutes or financial agencies.

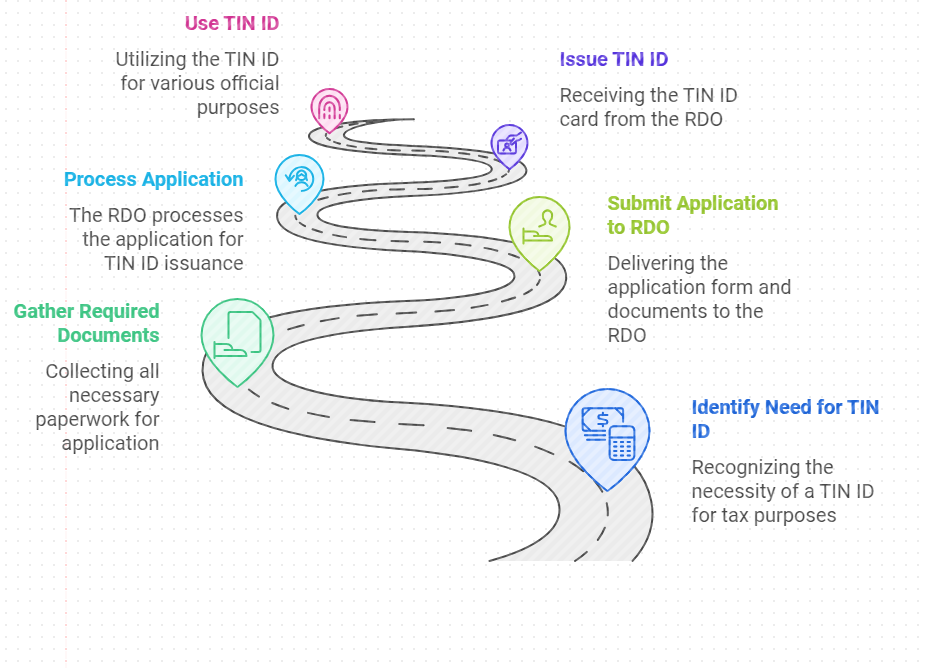

Process Of Obtaining A Tin ID In Philippines

Usage of TIN Card

This card is important and bears a different significance of use for different government agencies. Some government agencies, like NBI and PNP, consider TIN Card as valid Primary ID used for police clearance. Whereas some agencies, like PAG-IBIG Fund, Foreign Affairs Department, SSS, PSA, or Philippines Postal Corporation, recognize it as a secondary ID only. Moreover, Some business institutes do not consider it as a standalone ID. For example, it may be considered a standalone identification proof while opening a bank account in the banks like BPI or Metrobank, but not by Landbank.

So while making a transaction with government agencies or business institutes, you must bring a government-issued valid ID, such as a driver’s license, passport, or postal ID, as your primary identification and use a TIN card as a secondary ID.

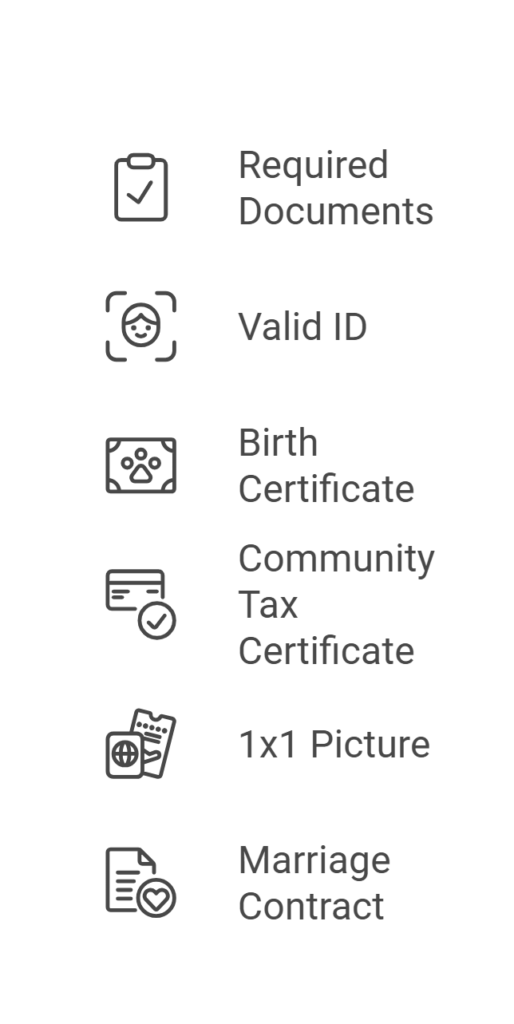

Basic TIN Requirements

TIN ID application is free of charge. Before we proceed to apply for a TIN ID, the taxpayer must have the following documents, especially if you are a first-time applicant.

- BIR Registration form (190 or 1904)

- Valid ID

- Birth certificate issued by PSA

- Community tax Certificate

- 1×1 picture

- Marriage contract (If applicable)

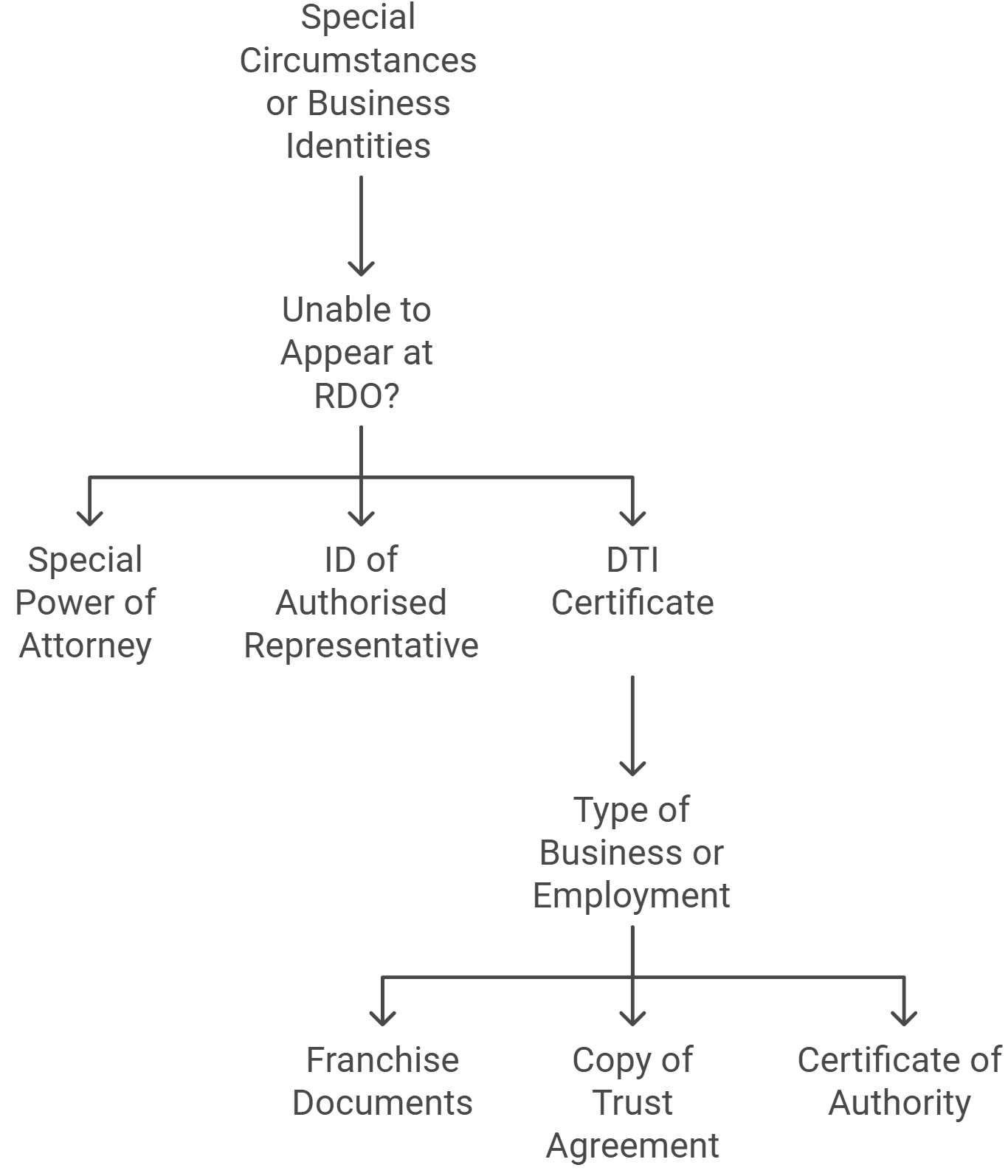

In case of some special circumstances or business identities, additional documentation is required, like:

- Special Power of Attorney and ID of the authorized representative instead of you, if you are unable to appear at RDO.

- DTI Certificate for business name to be printed on the card.

- Documents representing your employment and the type of business:

- Franchise Documents

- Copy of the Trust Agreement for trusts

- Certificate of Authority for Micro Business Enterprises

Important Note: Within ten days from the day you start the employment, an application form to get an ID can be submitted. In case of being late, you can also apply before your tax due date.

TIN ID Issuing Authority

The Revenue District Office (RDO) is the appropriate place for every taxpayer in the Philippines for the issuance of a TIN card. A court or authority has the power to make a decision about assigning the RDO based on where the applicant lives or where their business is located. An applicant has the right to update his information or request or replace his TIN ID at his designated RDO.

You may check your RDO by calling support at BIR customer Assistance Division on 8538-3200 or through email at [email protected]

Process to get a TIN ID Card

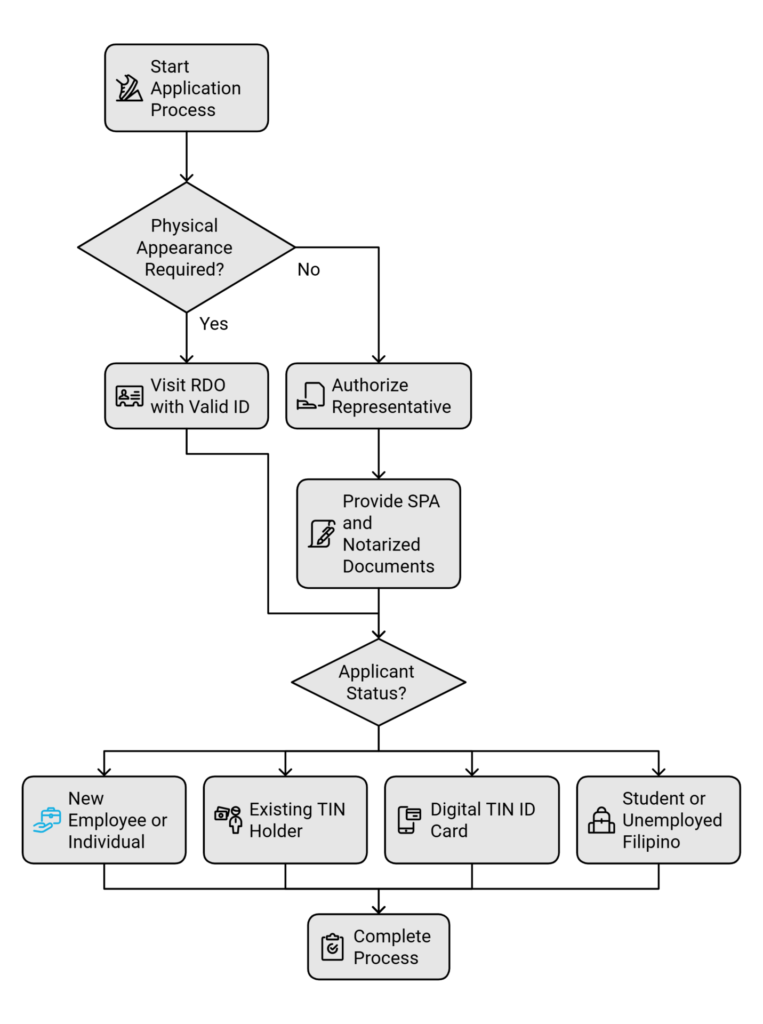

Its important to get through the right steps to obtain your TIN card from your RDO. According to BIR Revenue Memorandum (Order # 37-2019), it is mandatory to show physical appearance along with their valid ID at RDO when applying for the TIN Card.

In case of any emergency or valid reason when an applicant cannot visit the designated RDO, they can send an authorized representative on the given date for appearance at the branch. Make sure to provide a special power of attorney (SPA) indicating the reason for not appearing physically at RDO, a document notarized by the notary public duly signed by you, mentioning the relationship of the representative with the applicant to apply and process the TIN card.

There is a slight difference in process according to the applicant status. We are providing you with a guideline to understand the application process to get your TIN based on the following applicant categories:

- New employee or individual

- Employee or individual with existing TIN

- Digital TIN ID Card

- Students and unemployed Filipinos

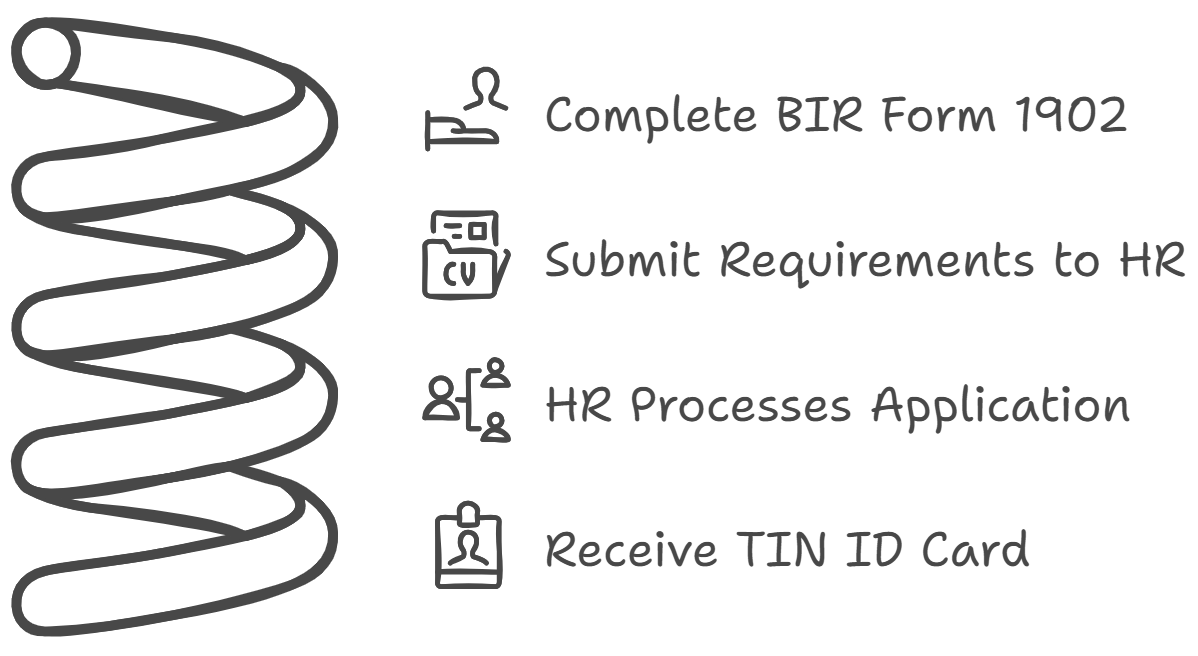

TIN Card for New Employees

TIN ID applications by new employees are processed by HR department. A newbie tax payer can follow the following steps to get his TIN ID:

- Complete the BIR Form 1902 by including personal information and relevant details.

- Submit TIN ID requirements to your HR.

- HR will help to process the application further.

- You can receive your card in a few working days.

Note: If an applicant wants to process the application himself and not through HR, he has to visit the RDO where the applicant’s company is registered and has to submit all the BIR ID requirements. This leads to processing the ID within the day.

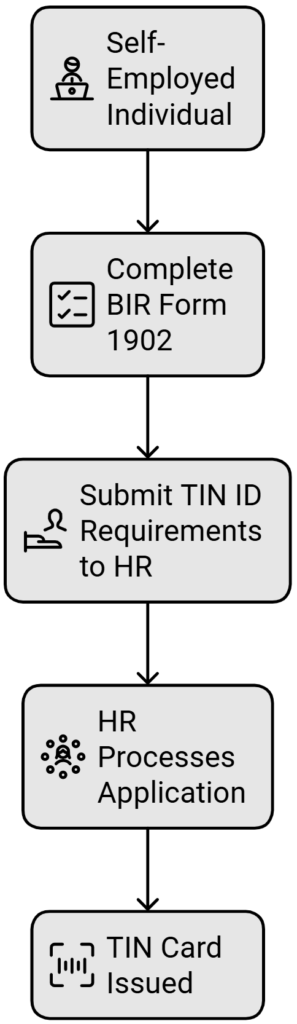

TIN Card for Employees & Individuals with Existing TIN

The same process and documentation are required while applying as self-employed individuals with an existing TIN and want to apply for a TIN card.

- Complete the BIR Form 1902 by including personal information and relevant details.

- Submit TIN ID requirements to your HR.

- HR will help send the application to process further.

Note: Personal appearance is mandatory; however, a representative can be appointed with the protocols mentioned above.

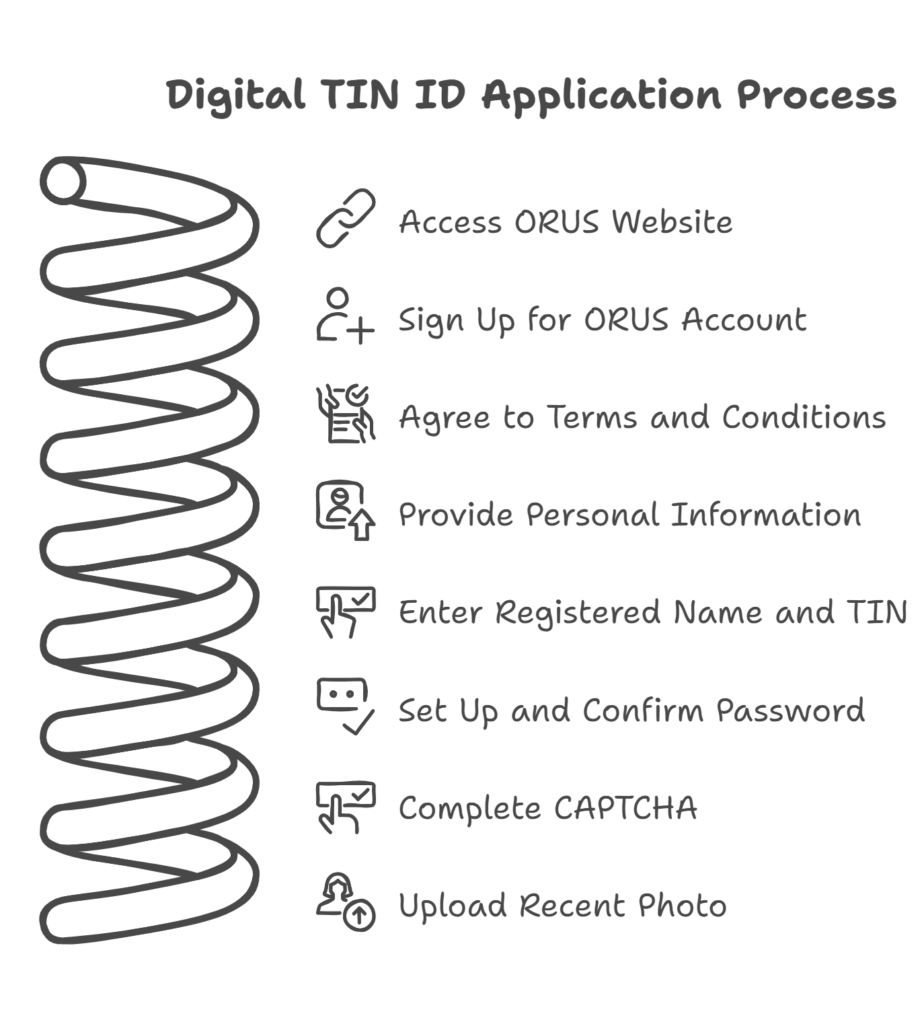

Digital TIN Card

A TIN card can be applied online as well in order to save time and travel hassle. This will also prevent fixers and scammers selling TIN IDs on different. Good news has been announced by BIR for existing TIN card Filipinos that they can get their digital card online through the Online Registration and Update System (ORUS).

It is mandatory to update your email address in RDO before you apply for online digital card. For this, you have to complete the Registration Update Sheet, i.e., the S1905 Form, and email it to your RDO. Signatures are not needed for digital TIN, but you can verify it by QR Code scanning through your mobile phone camera on ORUS.

Moreover, if you already have your digital TIN, a hardcopy of the TIN is not required in such a case. Your Digital Tin will serve as a valid ID.

Here is a step-by-step guide on how to apply for a digital TIN ID.

- Open the website by clicking on orus.bir.gov.ph and sign up for an ORUS account by clicking ‘New Registration’.

- Create an account by providing personal details.

- Go through the ‘Terms and Conditions’ pop-up on the screen by ORUS, check the box after reading them, and click agree.

- Fill in the required information and give the right information on whether you are a taxpayer and have an existing TIN, etc.

- Type your registered name and email address and enter your existing TIN in the required field.

- Setup and confirm your ORUS password.

- Check the captcha and click register.

- Upload your recent 1×1-sized photo to your account. Consider these specifications for your photo. It must be taken within the last 6 months with a white background and no borders. Your whole face must be clearly visible and without glasses or a hat.

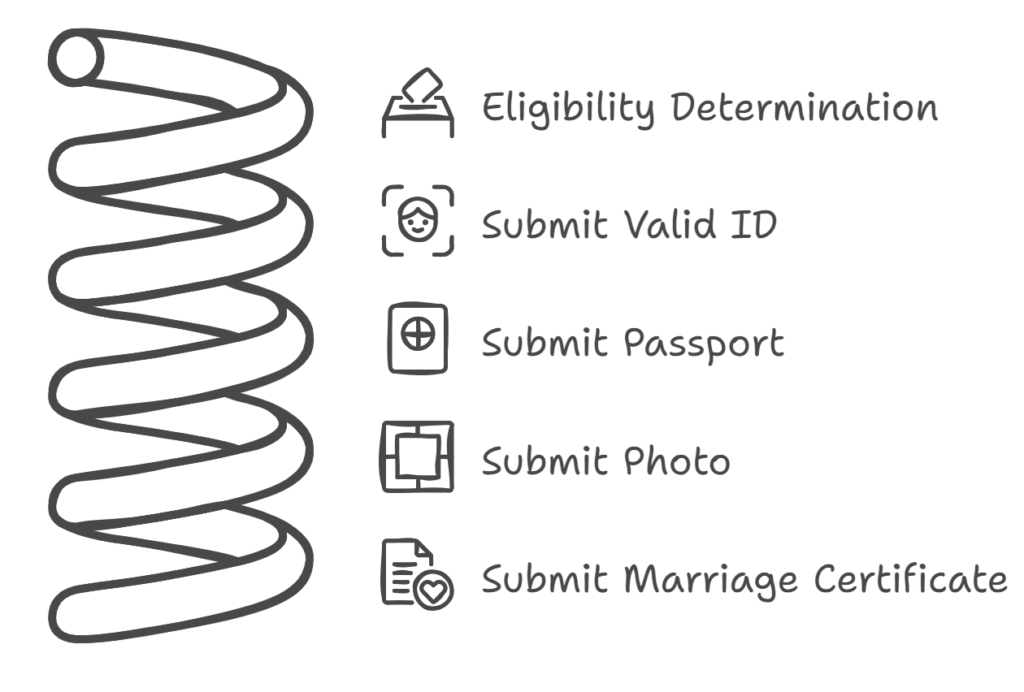

TIN Card for Students & Unemployed Filipinos

Under Executive order No. 98, Filipinos above 18 can get TIN ID. The following requirements must be submitted for students and unemployed individuals.

- Valid ID or any government-issued ID like a driving license, passport, birth certificate, community tax certificate, or any other identification.

- Passport (for non-residents)

- 1×1-sized picture with white background

- Marriage certificate (for married women)

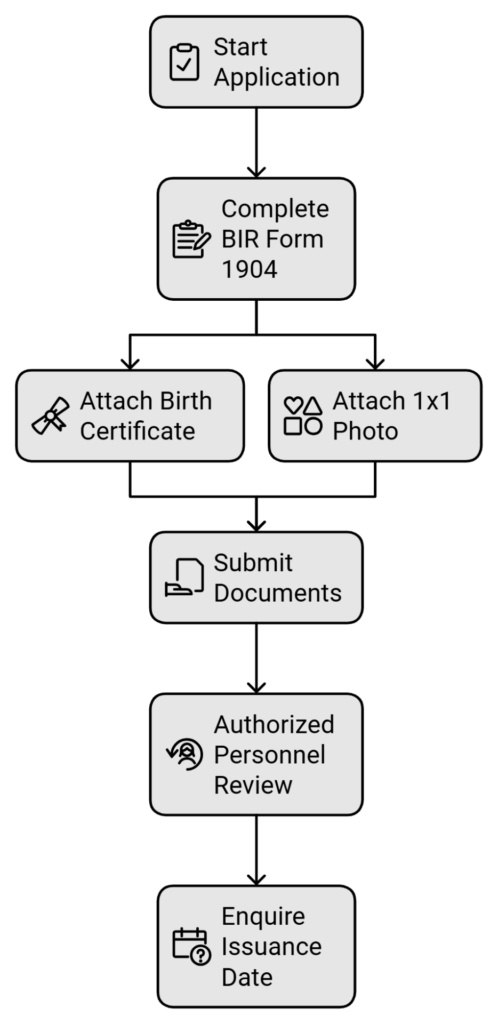

Here are the steps that can be followed to get your BIR TIN ID.

- Complete BIR Form 1904

- Attach your birth certificate

- 1×1 photo.

- Submit the documents to the authorized personnel of the designated RDO in your city.

- Enquire for the issuance date of your TIN ID.

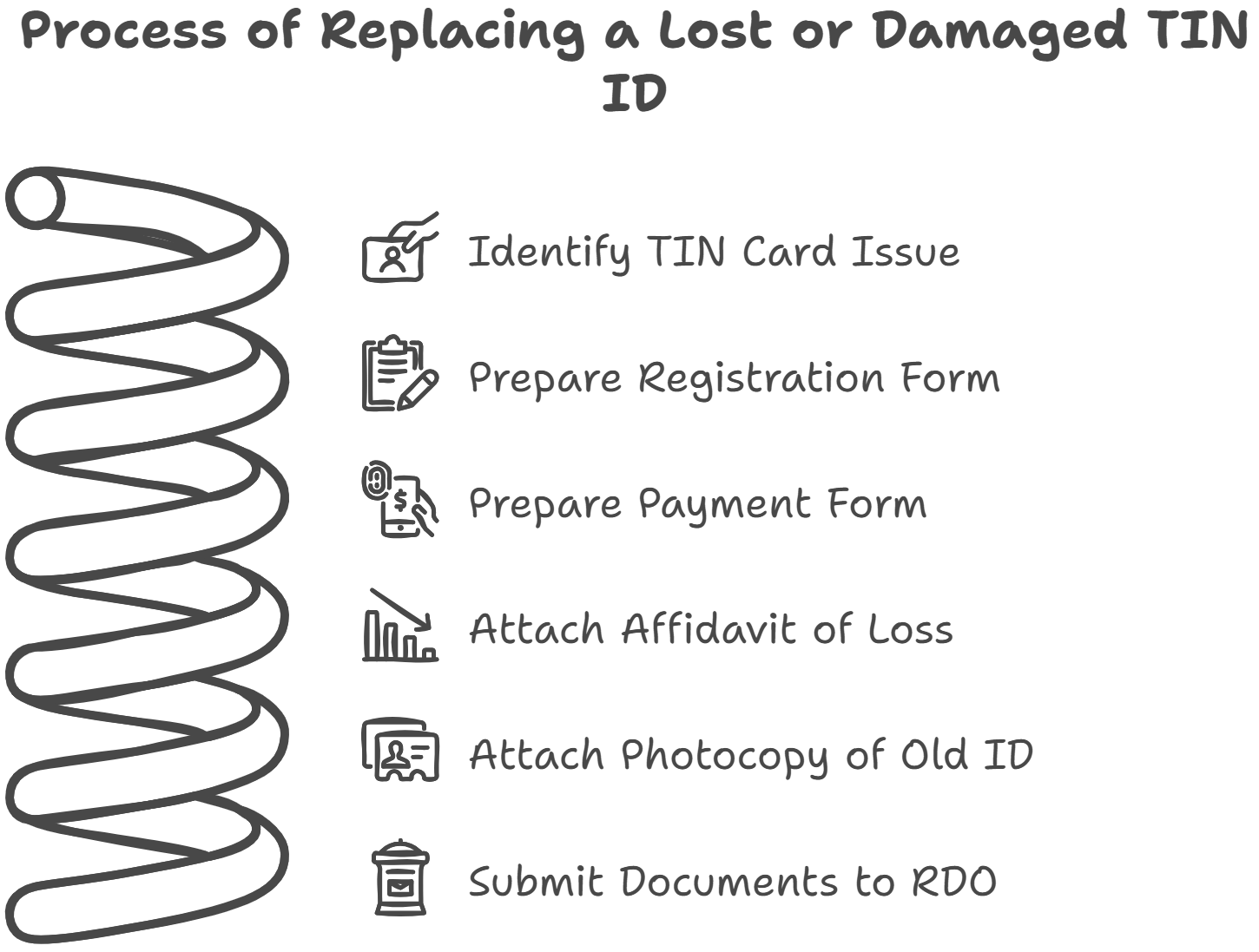

Replacing Lost TIN ID

Do not panic if your TIN Card gets damaged or lost. Follow these steps in case of any such incident to replace your TIN Card from BIR. Prepare the following documents to attach along.

- Fill and complete the ‘Registration Information Update Form. (BIR Form 1905)

- Also fill and complete the ‘Payment Form’. (BIR Form 0605)

- Attach a notarized affidavit of loss for the lost TIN.

- Attach the old ID card’s photocopy for the damaged TIN.

- Marriage certificate.

- Submit your application form along with the required documents to your designated RDO.

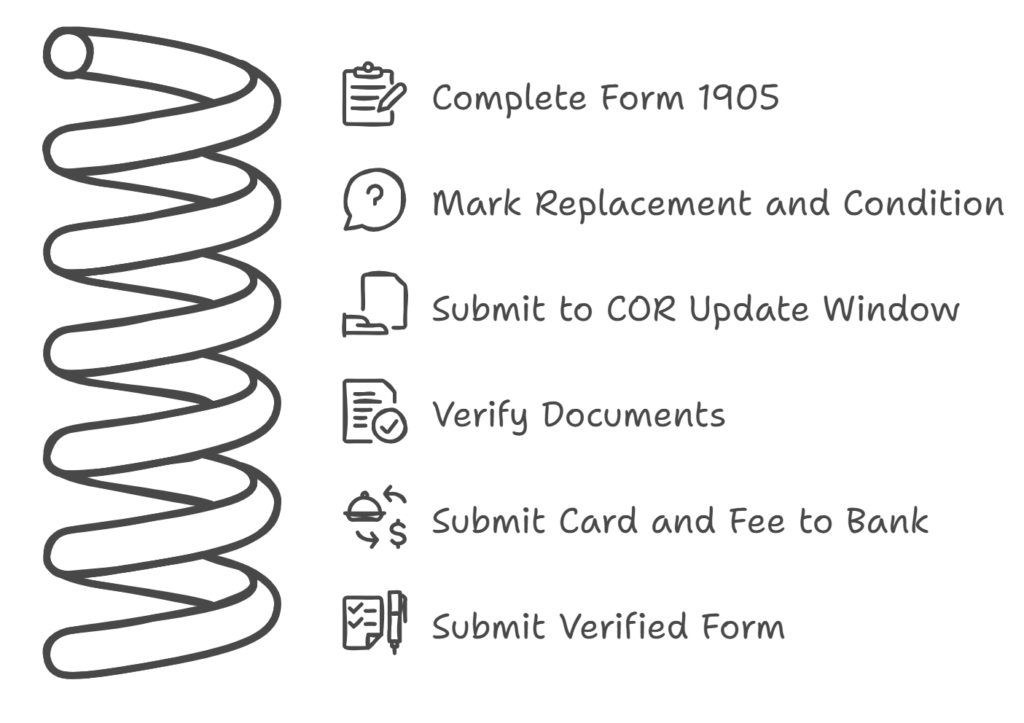

Here are certain steps to be followed before you submit your application and required documents.

- Fill and complete Form 1905 by R. Put a X on the ‘Replacement of Taxpayer Identification under Part II.

- Put a X on the lost/damaged.

- Open the Certificate of Registration (COR) Update window and submit your completed Form 1905 and the Payment Form 0605. Get your documents verified at the counter.

- Submit the damaged/lost card and the fee to RDO’s agent bank.

- Submit your machine-verified Form 0605 with the fee payment receipt to the COR Update window.

The same process will be followed while updating the information on your card and your civil status, including corrections of misspelt words. You have to fill out the BIR Form 1905 and mark the relevant reason with X in the given boxes.

Important Reminders

Avoid Fixers and Scammers

Offers on online platforms on how to replace or recover your lost TIN ID are spam and illegal because they are not authorized by BIR. Such fixers get money rom you without providing any services. Getting a TIN is a simple process, so it’s better to do it yourself and save money too.

Use Only One TIN ID for Life

Your unique TIN is useful in every tax-related activity. If you’re a taxpayer, use your TIN once and lifetime, which can be useful from filing an annual income tax return to applying for a business permit. You don’t need a new TIN number if you move to a different city. Your TIN will stay valid until you’re a taxpayer in the Philippines. Keeping two or multiple TINs is considered a crime.

Frequently Asked Questions (FAQs)

How can we get online TIN verification?

Click on BIR website at https://www.bir.gov.ph. Login to the BIR website to verify your TIN. Through Chatbot, you can do TIN inquiry, TIN validation, or find the RDO by clicking the “RDO Finder”.

Can we get a TIN ID in one day?

A TIN ID can be issued within one day of processing. If you submit the requirements after the office’s 1:00 PM cut-off, you can claim your card the next working day.

Which app can you use TIN ID for verification?

Seach the ‘BIR TIN Verifier Mobile’ application in Google Play and click on the install button. The app is available on the Google Play Store for Android users but not for iOS users.

How much is the cost of a TIN ID?

First-time application of TIN Card is free of charge. In case of a lost or damaged TIN card, P100.00 is the replacement fee.